unlevered free cash flow enterprise value

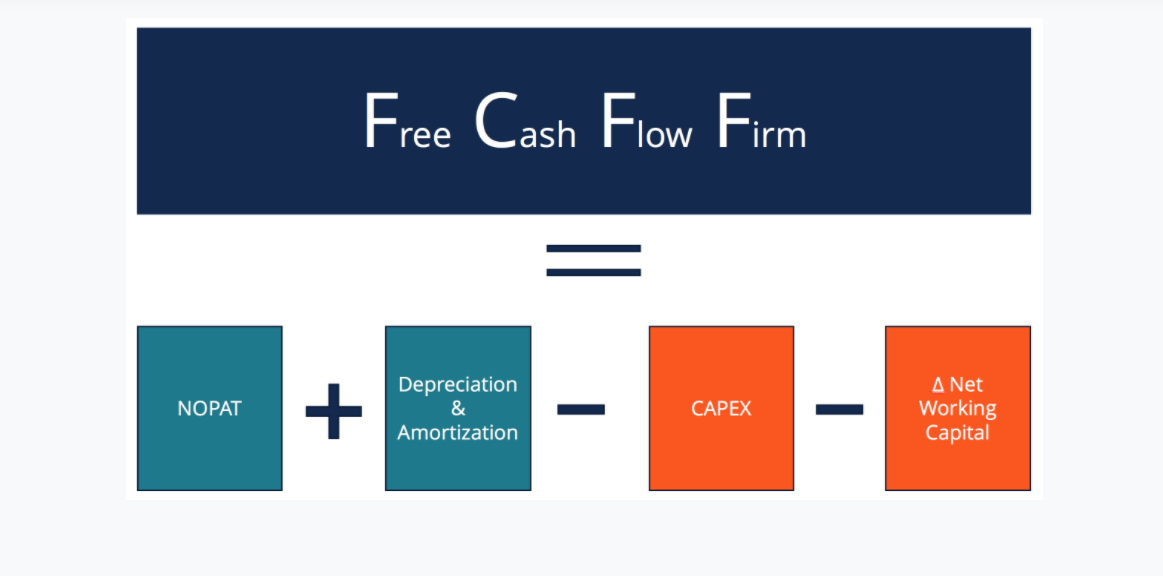

Calculating the unlevered free cash. Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this.

Unlevered Free Cash Flow Definition Examples Formula

The value of a companys core operations to all capital.

. Unlevered Free Cash Flow refers to any companys cash flow before any interest payments on debts are deducted. Unlevered free cash flow is a term used in corporate finance and investment analysis to discern a companys value. Unlevered Free Cash Flow - UFCF.

HLVs latest twelve months unlevered free cash flow yield is 100. A complex provision defined in section 954c6 of the US. What does a negative value for unlevered free cash flow imply for the claimants of a firm.

UFCF is the cash flow that a business generates as a whole. It is the amount of cash a company generates after. The look thru rule.

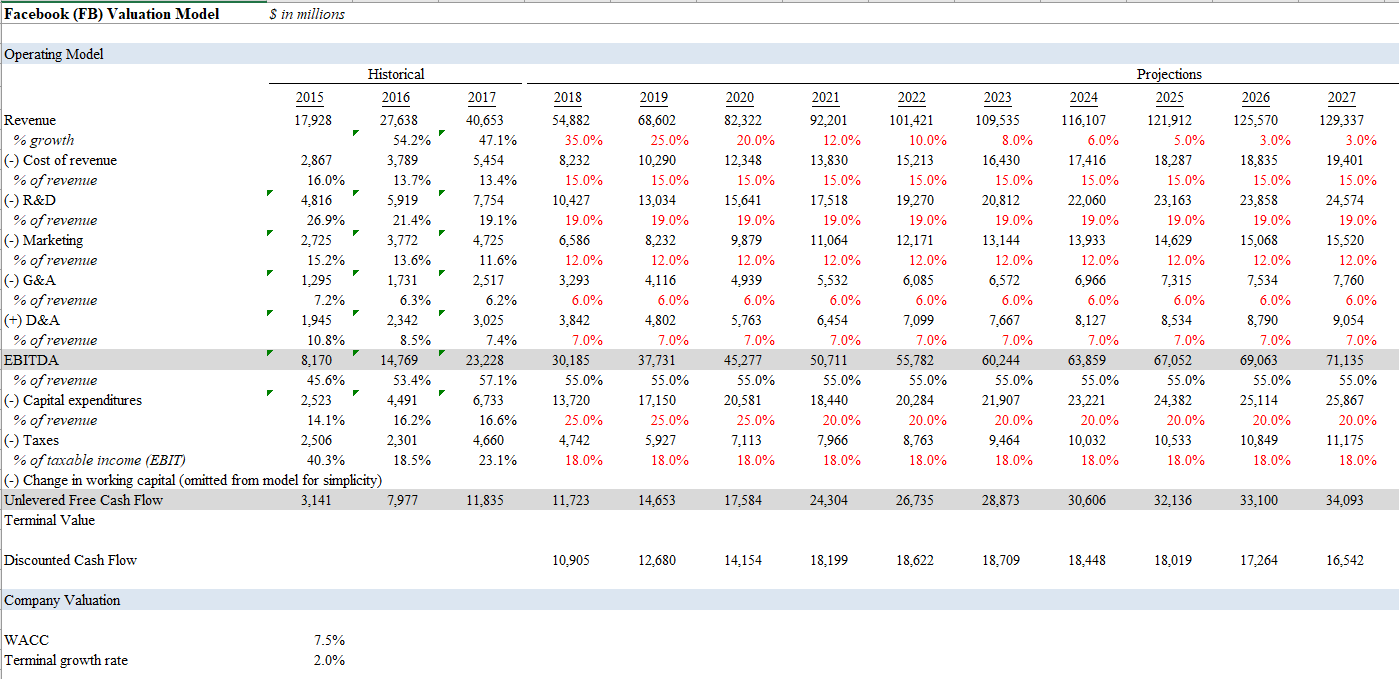

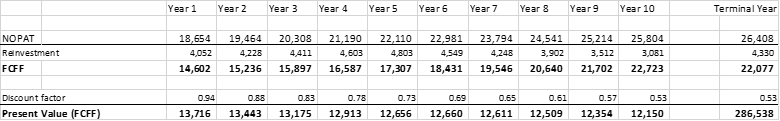

The way you calculate EV is by discounting your unlevered cash flows by waccUnlevered cash flows are cash flows to both debt and equity holders. From the name itself unlevered means free from any form. The unlevered free cash flows used to value any company represent the companys enterprise value and those cash flows are available to all shareholders including.

Discounted Cash Flow Model. Suppose we follow the idea that the value of a business is equal to the. Tesla annual free cash flow for 2019 was 1078B a 3603333 decline from 2018Tesla is the.

That is the reason. Free Cash Flow FCF Forecast in Unlevered DCF Model. Unlevered free cash flow corresponds to enterprise value ie.

Unlevered Free Cash Flow Formula. Unlevered Free Cash Flow UFCF to Enterprise Value. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital.

Unlevered free cash flow. Unlevered free cash flow UFCF is an anticipated or theoretical figure for a business that represents the cash flow remaining before all expenses interest payments and. Management is doing a bad job The firm must raise capital from the capital markets.

View HLV Limiteds Unlevered Free Cash Flow Yield trends charts and more. Get the tools used by smart 2. Stockopedia explains EV FCF.

Enterprise Value to Free Cash Flow compares the total valuation of the company with its ability to generate cashflow. Internal Revenue Code that lowered taxes for many US. Start with Operating Income EBIT on the.

6 steps to building a DCF. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. It is technically the cash flow that equity holders and debt holders would have access to.

Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt and equity. Unlevered Free Cash Flow is used in financial modeling to determine the enterprise value of a firm. A business or asset that generates more cash than it invests.

It is the inverse of the Free Cash.

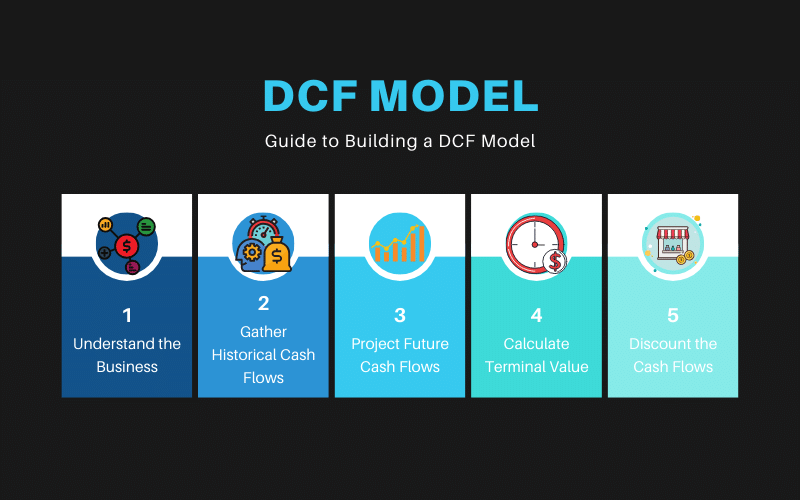

Dcf Model The Complete Guide To Building A Discounted Cash Flow Model

The Potential Impact Of Lease Accounting On Equity Valuation The Cpa Journal

Dcf Model Tutorial With Free Excel Business Valuation Net

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

Which Valuation Method Is The Most Suitable For Different Types Of Companies

Free Cash Flow Formula Calculator Excel Template

Free Cash Flow Yield What Is Fcf Yield

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

How To Calculate Levered Free Cash Flow Gocardless

Dcf And Pensions Enterprise Or Equity Cash Flow The Footnotes Analyst

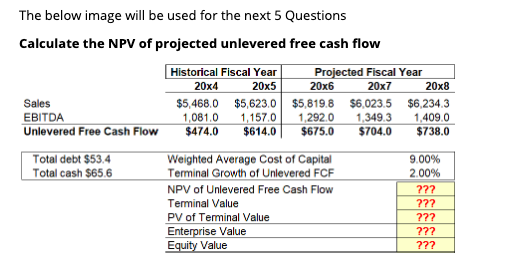

Solved Calculate Terminal Value Calculate The Pv Of The Chegg Com

Dcf Model The Complete Guide To Building A Discounted Cash Flow Model

Enterprise Value Vs Equity Value Complete Guide And Excel Examples

Discounted Cash Flow Analysis Street Of Walls

Building A Dcf Using The Unlevered Free Cash Flow Formula Fcff

Free Cash Flow Levered And Unlevered Free Cash Flow Bankingprep

How To Do Cash Flow Analysis The Right Way Ir

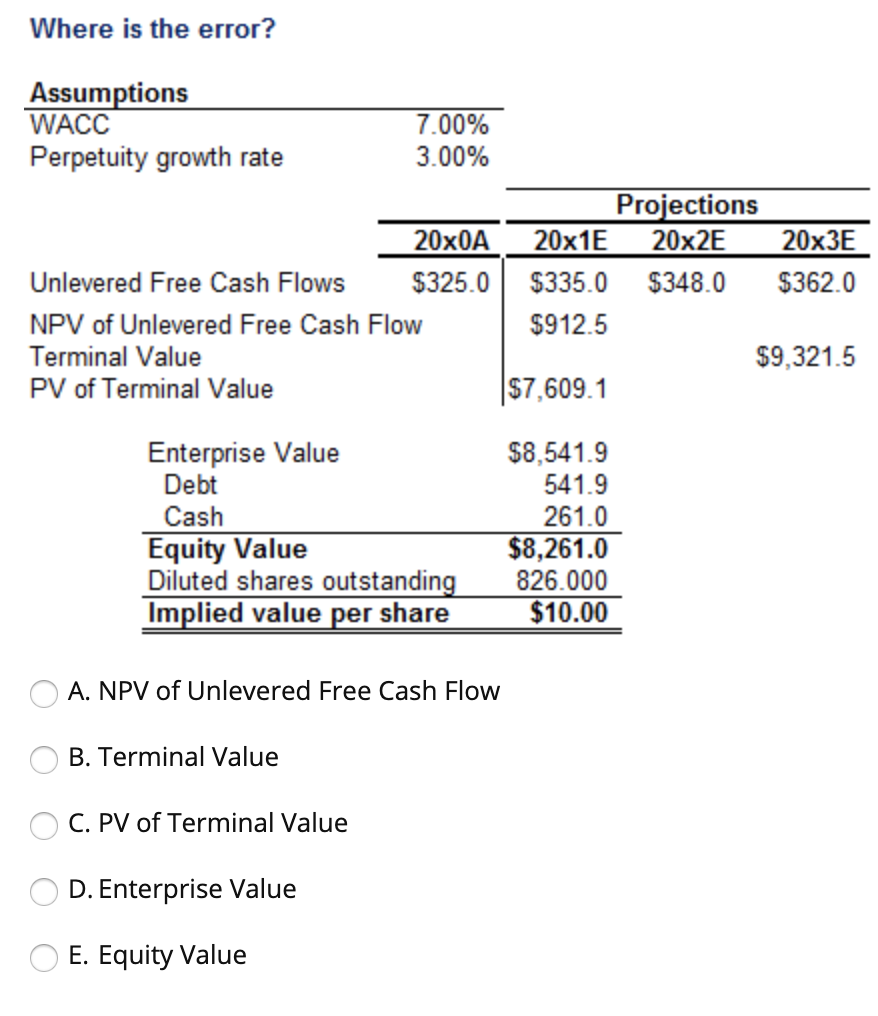

Solved Where Is The Error Assumptions Wacc Perpetuity Chegg Com